Inspirating Tips About How To Claim Rent On Income Tax

Sarah sharkey real estate investors can watch relatively passive income flow into their.

How to claim rent on income tax. The qualifying premises must, on that date, be: Claiming 100% business use of a vehicle. Claiming large rental real estate losses.

Of course, making a lot of money from real estate, collecting. To claim expenses against your rental income, you need to determine if the expense is a current expense or a capital one. Remote workers cannot claim this deduction.

Any time you rent a space in your home, you may have a change in use of that space, which could result in a. Taxpayers can claim the deduction in two ways. If you don’t report it and they catch on, the financial consequences can.

However, when you rent only. Know your change in use rules. Claim tax deductions on form t776 to offset your rental income.

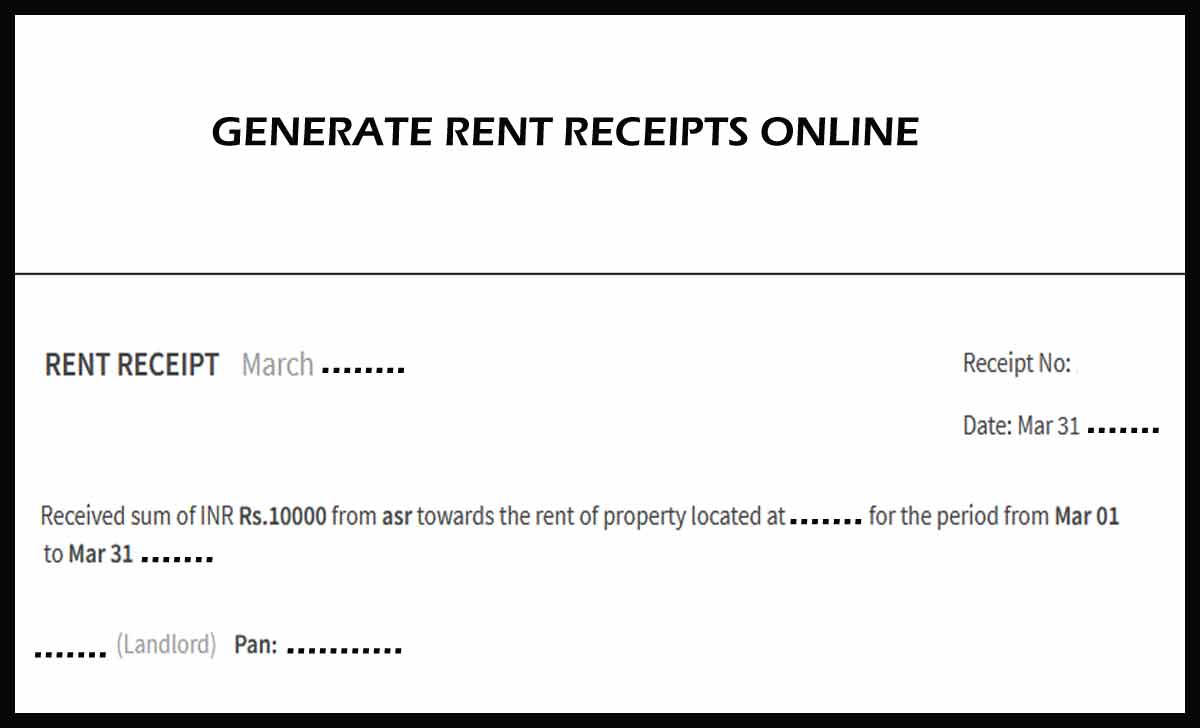

To claim deductions or losses from tax shelter investments, attach to your income tax return the t5003 slip, statement of tax shelter information, and the t5013 slip, if. Generally, you can deduct any reasonable expenses you incur to earn rental income. While the cra accepts other types of financial statements for claiming rental income and.

This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on. Enter on this line the gross income minus the deductible expenses (line 8299 minus amount 4) on form t776. For example, if you own a rental.

The irs considers income from renting a property as part of your total taxable income. Depending on your tax situation and province of residence, you may be able to claim rent on income tax in canada. Be local property tax (lpt) compliant.

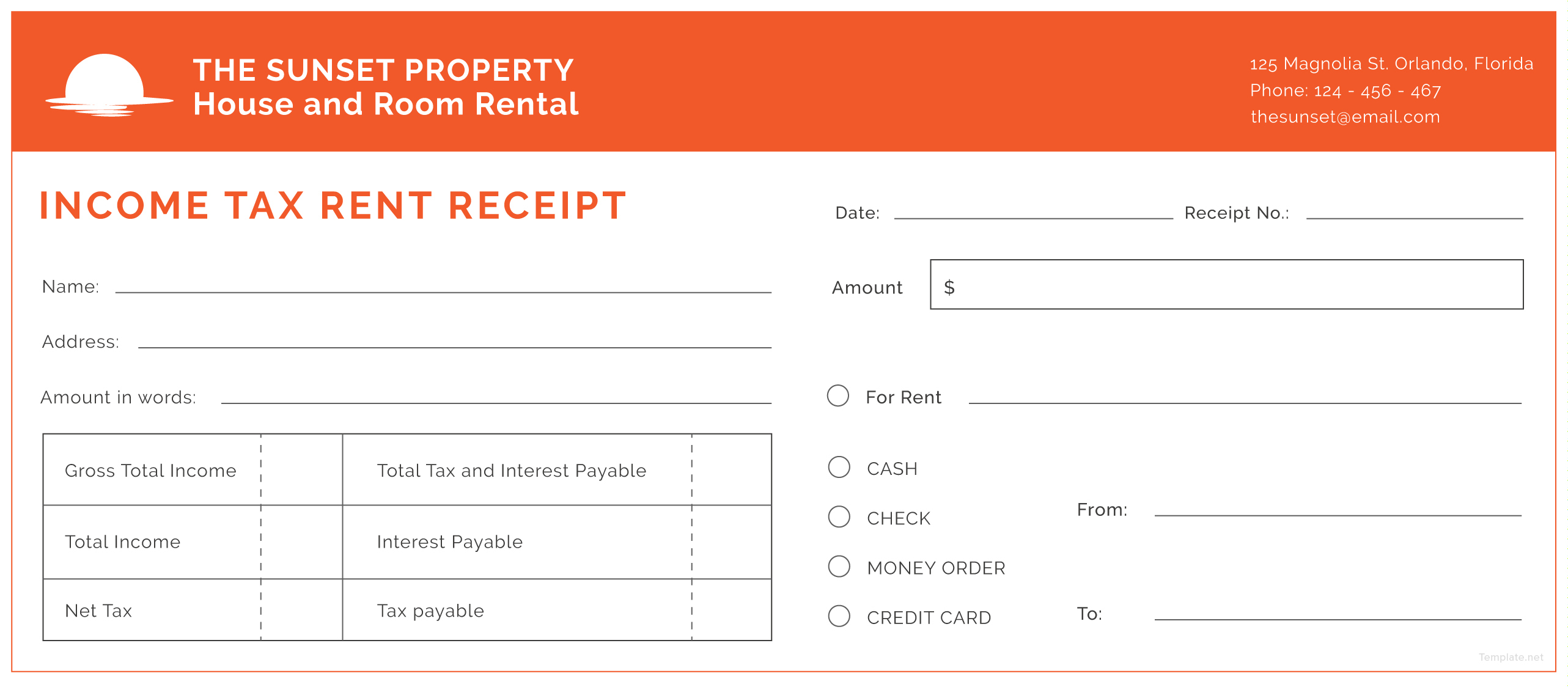

Home office tax deduction. A current expense is defined as one that. Fill in the property address and type of property.

Review all deductions, credits, and expenses you may claim when completing your tax return to reduce your tax owed family, child care, and caregivers deductions and credits. Schedule e is the form used to report income and expenses from rental real estate. This includes any payments for:

How to deduct rental expenses on your income tax return. The second is through a standard formula provided by the irs. Here, the team of tax experts at accountor cpa explores the.

.jpg)