Ideal Info About How To Get Out Of Paying Income Tax

Helps you work out:

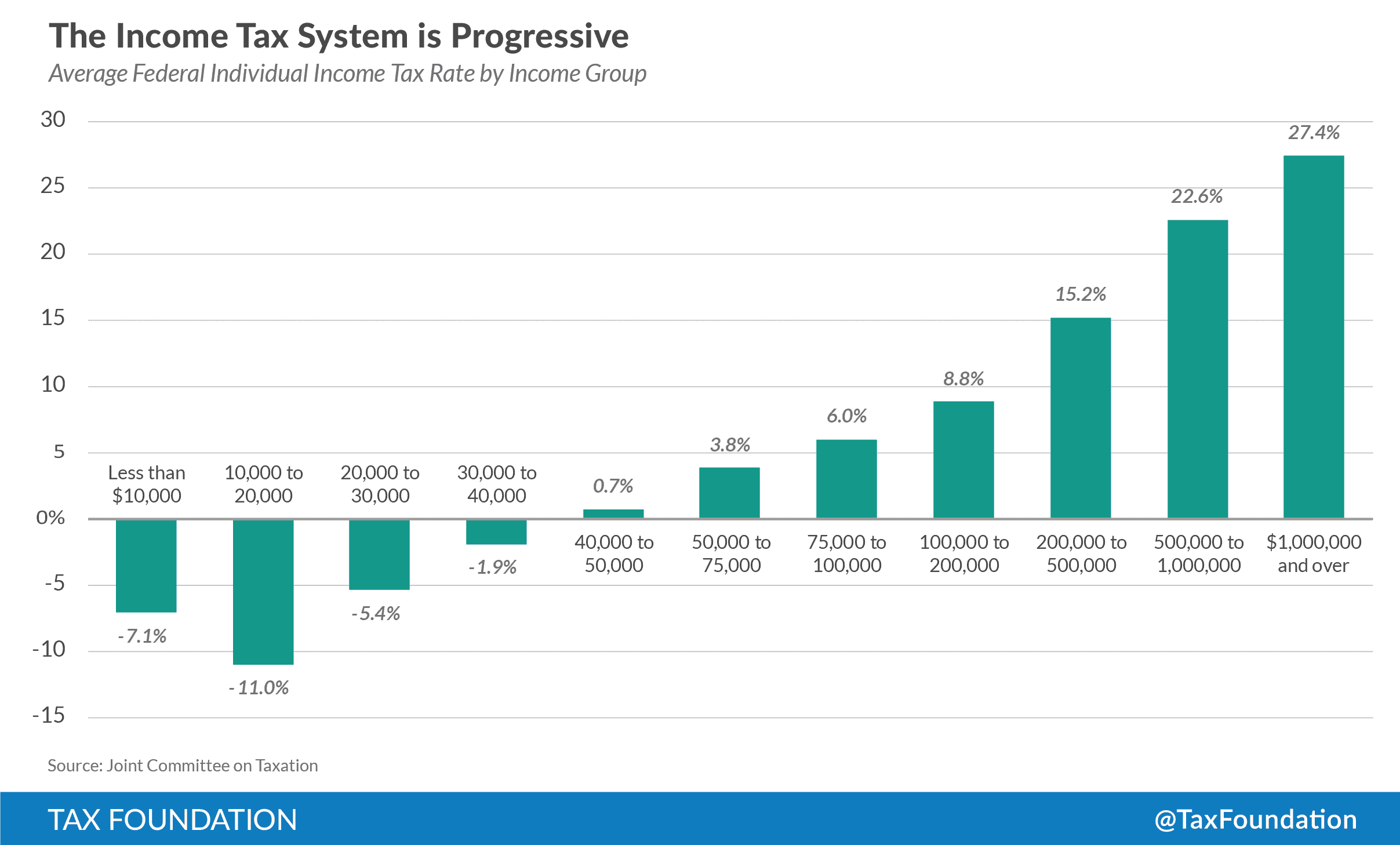

How to get out of paying income tax. It turns out that you can avoid paying taxes if you understand some of the ins and outs of the tax code. Getting married can change your tax bracket, which is the highest imposed rate of tax on your income. More than $44,000 per year.

The alternative plan, which has become known as biden’s “plan b ,” could forgive the student debt for as. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing. The good news is that you'll never pay taxes on more than 85% of your benefit amount.

How to get out of tax debt the irs is usually willing to work with you by william perez updated on february 23, 2022 reviewed by ebony j. What your take home salary will be when tax and the medicare levy are removed. One of the fastest and easiest ways for tax deduction is to live outside the united states the vast majority of the time.

Written by mark nestmann october 8, 2019 many americans believe that the federal income tax as it’s now imposed is likely unconstitutional. And in many cases, some americans have turned not. You can take capital losses before the end of the tax year to offset your capital gains, and you can use up to $3,000 of excess capital losses to offset your.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Input your income, deductions, and credits to determine your potential bill or. Irs installment agreements:

The standard deduction on your income taxes. And so it turns out that the billionaire class pays much less in tax than average people. Skip filing your taxes, and the irs will come calling.

Canadians can begin filing their. You can also live without paying taxes by obtaining citizenship through a citizenship by investment program in a country like antigua and barbuda that doesn’t. How much australian income tax you should be paying.

When you get paid, your employer takes out a portion of your. That debt cancellation could come as soon as this year. They avoid income.

And when it does, you'll likely. Income in america is taxed by the federal government, most state governments and many local governments. Write off all your business expenses tax trick #2:

If you're not taken to a page that shows your refund status, you. Tax trick #1: 401 (k) rollover the easiest way to borrow from your 401 (k) without owing any taxes is to roll over the funds into a new retirement account.

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)