Heartwarming Tips About How To Manage Ira

We earn a commission from partner links on forbes advisor.

How to manage ira. The basics learn the fundamentals of saving for retirement with an ira, including what to do when you have an old 401(k) or. Potential income includes income from iras, 401 (k)s, and reverse mortgages. Why choose fidelity go for your ira?

An easy way to ira. Whether you are just starting out or midway into your career, understanding how to open an ira and fund it will propel you. A td ameritrade ira comes with advantages and features that make investing for your future easier.

You can start saving and investing for retirement through a roth ira now by following these steps: With fidelity go ®, answer a few questions. If you're also investing in a retirement plan where you work—like a 401 (k) or 403 (b)—think about how the funds you choose for your ira will.

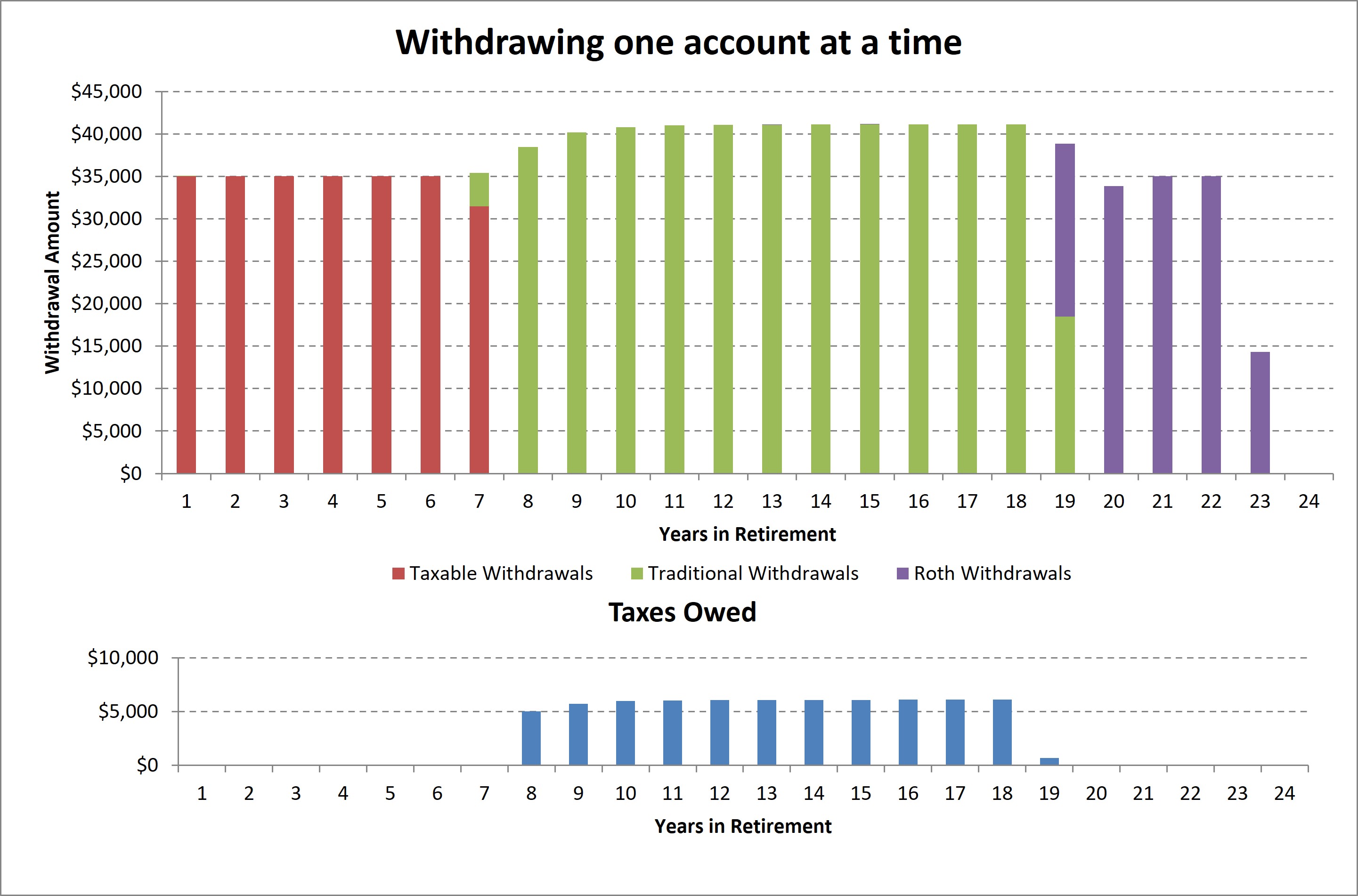

But it's not too late to manage your tax liability. Plan for your retirement with an ira from td ameritrade. How to open an ira.

Roth iras let you save and invest money you've already paid taxes on. Here’s what you need to know to help you choose an ira. Commissions do not affect our editors' opinions or evaluations.

A rollover involves three steps: Is it better to pay taxes now or in retirement? Two types of retirement income include regular and potential.

The form is usually short, asking for the account number and the provider holding the funds now. This gives you even more flexibility in selecting when and. Ira contributions can't be deducted from your paycheck since you—not your employer—manage your ira.

Fill out your ira provider's rollover form. Two main types of individual retirement accounts (iras) are available to you, and whether you choose a traditional ira or a roth ira (or some. From ira basics and rollovers to contributions and withdrawals, let fidelity teach you about which ira may be right for you and how to manage it.

Fact checked by lars peterson. Fidelity can help build and manage a portfolio that fits your needs, depending on your ira type: To contribute to a roth ira, your.

Should older workers contribute to. Updated on december 15, 2022. Help me understand the ‘best way’ to manage an ira.

![[PDF READ ONLINE] Manejo de la ira [Anger Manage taniyagravesのブログ](https://stat.ameba.jp/user_images/20230915/15/taniyagraves/fd/a0/j/o2400240015338338903.jpg)