Nice Tips About How To Obtain A Utr

How do you get a utr number?

How to obtain a utr. In this video i will show you step by step how to apply for. You should check if you need to send a tax. How to obtain a utr for a foreign company?

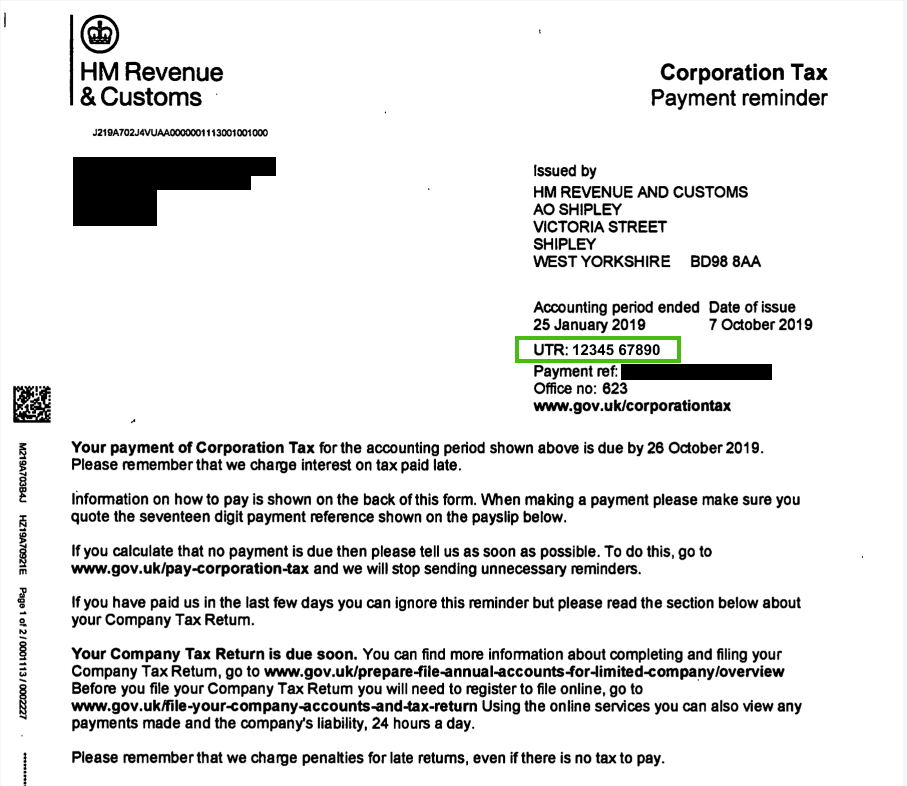

To obtain your utr number, follow these general steps: What is the format of a utr number for an rtgs transaction? To obtain a unique taxpayer reference (utr) for a limited company in the uk, you need to follow a specific process.

When you initiate a transaction, banks provide a reference. This activation code is necessary. What is the format of a utr number for an neft transaction?

Start your journey and step into the universal tennis global community. Here is a brief tutorial on how to get those utrs, pls let me know if you have additional questions/comments. You’ll need to provide essential information.

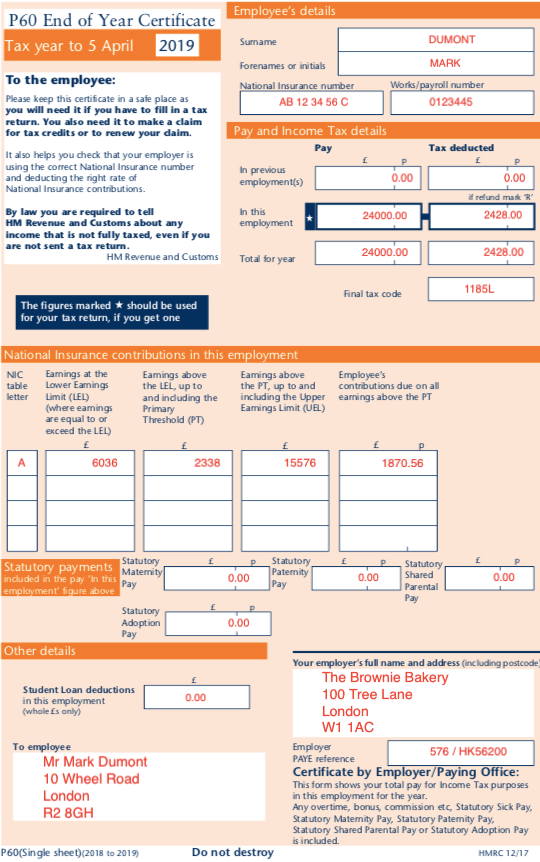

You can obtain your utr number by. Firstly, the company must be registered with companies. If you’re waiting for a unique taxpayer reference (utr), you can check when you can expect a reply from hmrc.

Table of contents. Here’s how to get a utr number. Register the estate with hmrc to obtain a unique taxpayer reference ( utr) by 5 october after the tax year when the estate starts to receive income or has.

How do i get my utr number? If you haven’t done so already, register with hmrc online. What you need to tell hmrc.

Unusual cis situation where a utr seems to be the only solution? If you have to send a tax return and you have not sent one before, you must register for self assessment, where your utr number will. The utr rating is the world’s most accurate tennis rating system.

The simplest way to find your utr number is to check your bank account statements or passbook. You can call your bank's customer care helpline to obtain the utr number for a specific transaction. Request your company’s utr online if you did not get one after registering your company.