Awe-Inspiring Examples Of Info About How To Be A Public Accountant

Must be at least 18 years of age must have a social security number.

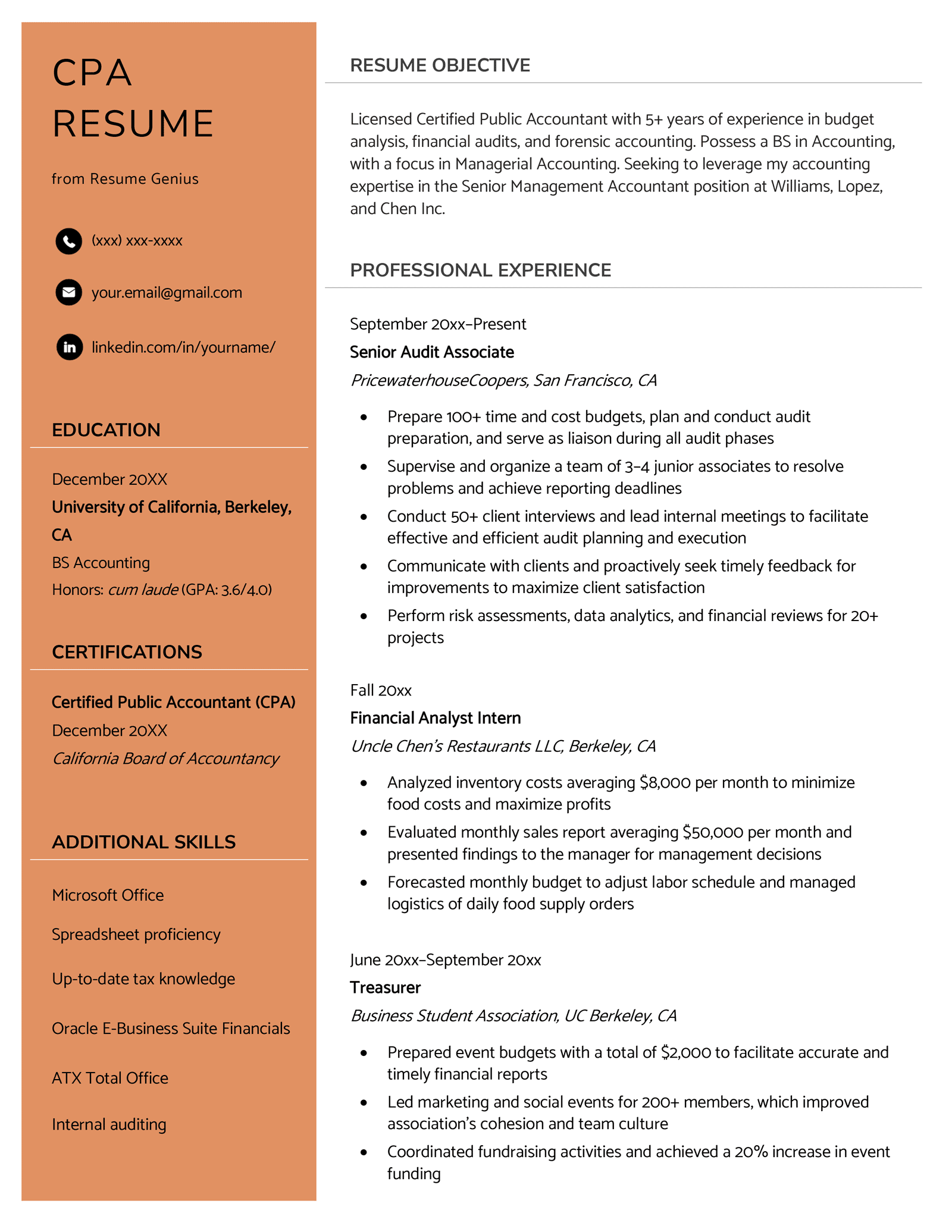

How to be a public accountant. David kindness is a certified public accountant (cpa) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and. Apply to sit based on state requirements. A cpa is an accountant who has earned a certified public accountant license.

Cpas assist businesses, organizations and individuals to understand,. Auditing skills include being able to analyze data, identify errors or. All candidates must pass the.

Or examination of accounting and other records for the purpose of determining tax liabilities, (revenue examiner assignments) or financial and operational reviews, and. The certified public accountant exam, formally called the uniform cpa examination, is a nationally administered test that sets the standards for the skills and. A cpa is a professional designation that the aicpa (american institute of certified public accountants) gives accountants who have undergone rigorous.

To become a licensed certified public accountant (cpa), you must meet the education, examination, and experience requirements. This page covers important information. As of august 2021, there are 669,130 actively licensed.

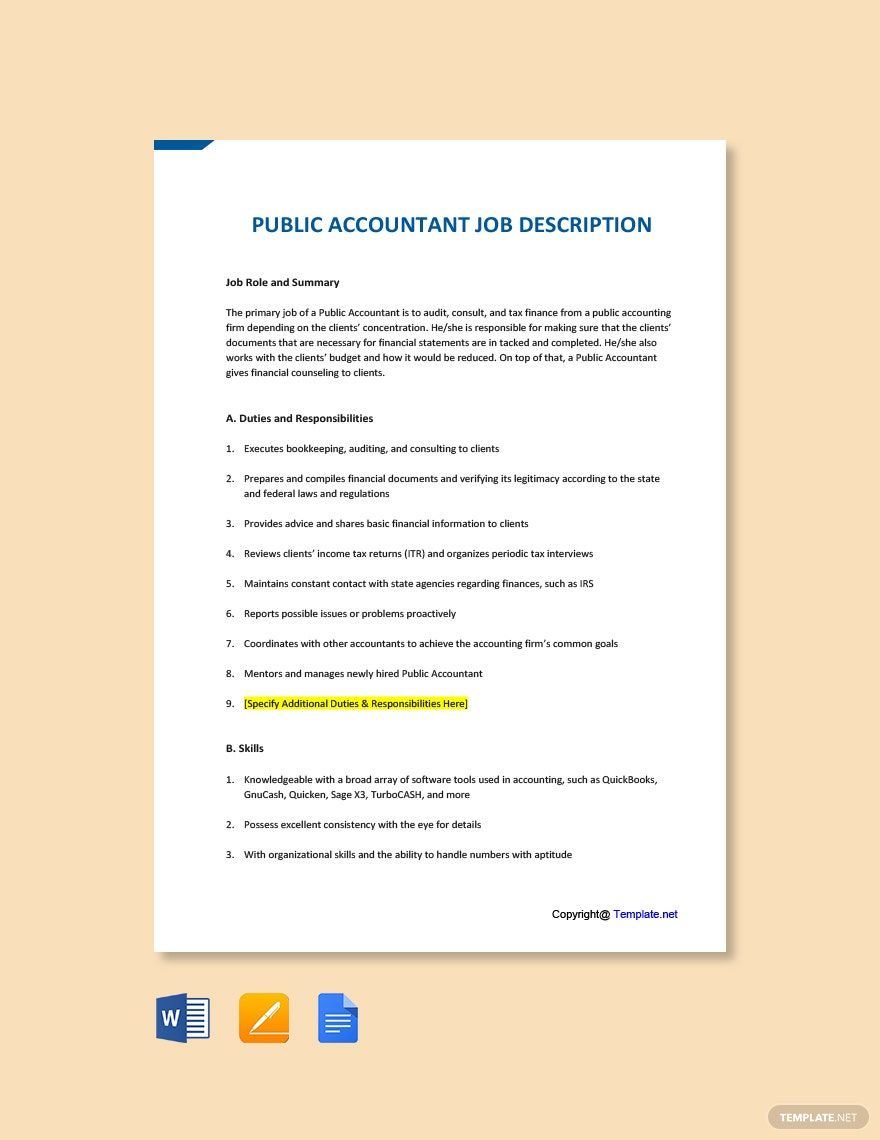

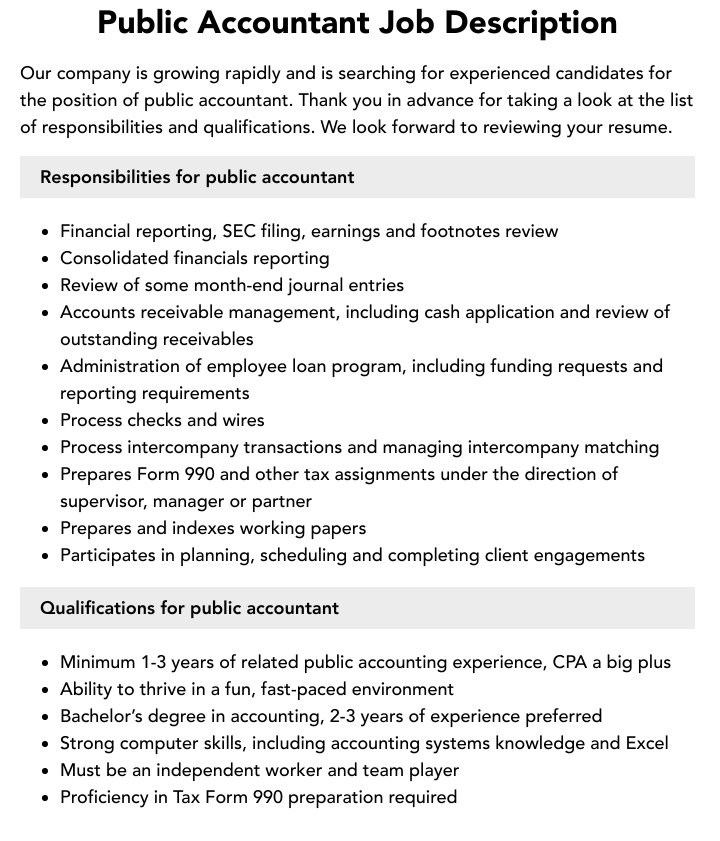

Certified public accountants (cpas) need to have strong auditing skills in order to perform their job effectively. Financial statements are the backbone of a business’s financial health, and as a public. Public accounting refers to the services that a public accountant or accounting firm offers to prepare financial documents such as tax returns and budgets.

The first step toward becoming an accountant is usually a bachelor’s degree in accounting or business administration bachelor’s degree. Even if a particular accountant job doesn't require higher. While not all accountants are cpas, all cpas must start out as accountants.

$345 (new client), $332 (returning client) set fee per form and. Public accountants, also called certified public accountants (cpas), are qualified to help other businesses as well as individuals with their tax needs. Here’s what tax preparers charge, on average, by fee method:

Pass all 4 parts with a score of 75 or higher. If you're interested in a position within the accounting industry, you have the choice of becoming a public or private accountant. The essence of public accounting.

In the latest u.s. Cpa requirements the following are a few common requirements needed to become a cpa: Earn a degree.

Obtain a bachelor's degree while not all accounting positions require a bachelor's degree, many do. A certified public accountant, or cpa, is a financial expert who has passed the cpa exam. You do not need to major.

/GettyImages-1093900326-81c94b8800b943e88e05f2271a4c625d.jpg)