Stunning Tips About How To Handle A Returned Check In Quickbooks

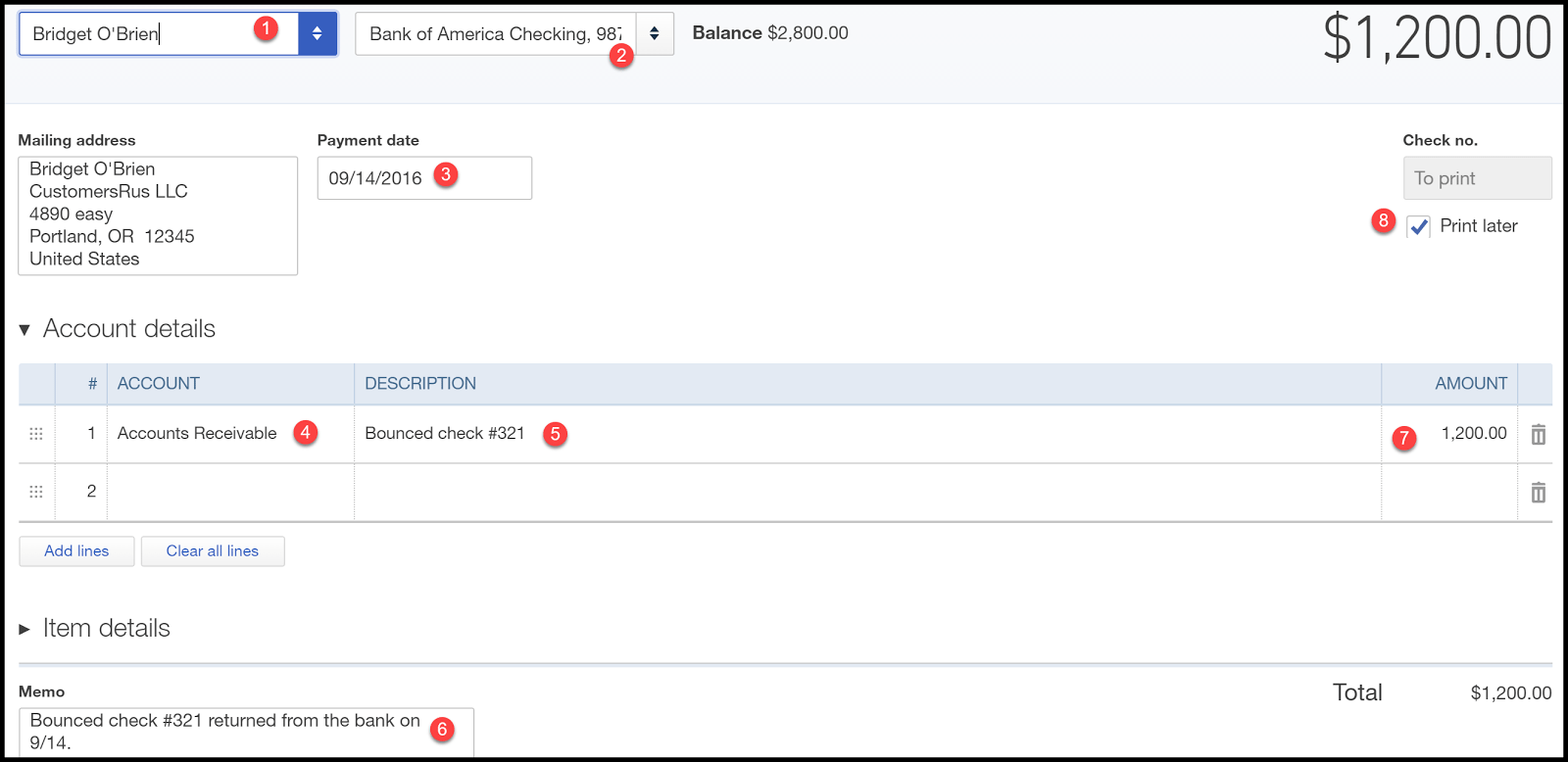

In the payee field, select the name of the customer who's check bounced.

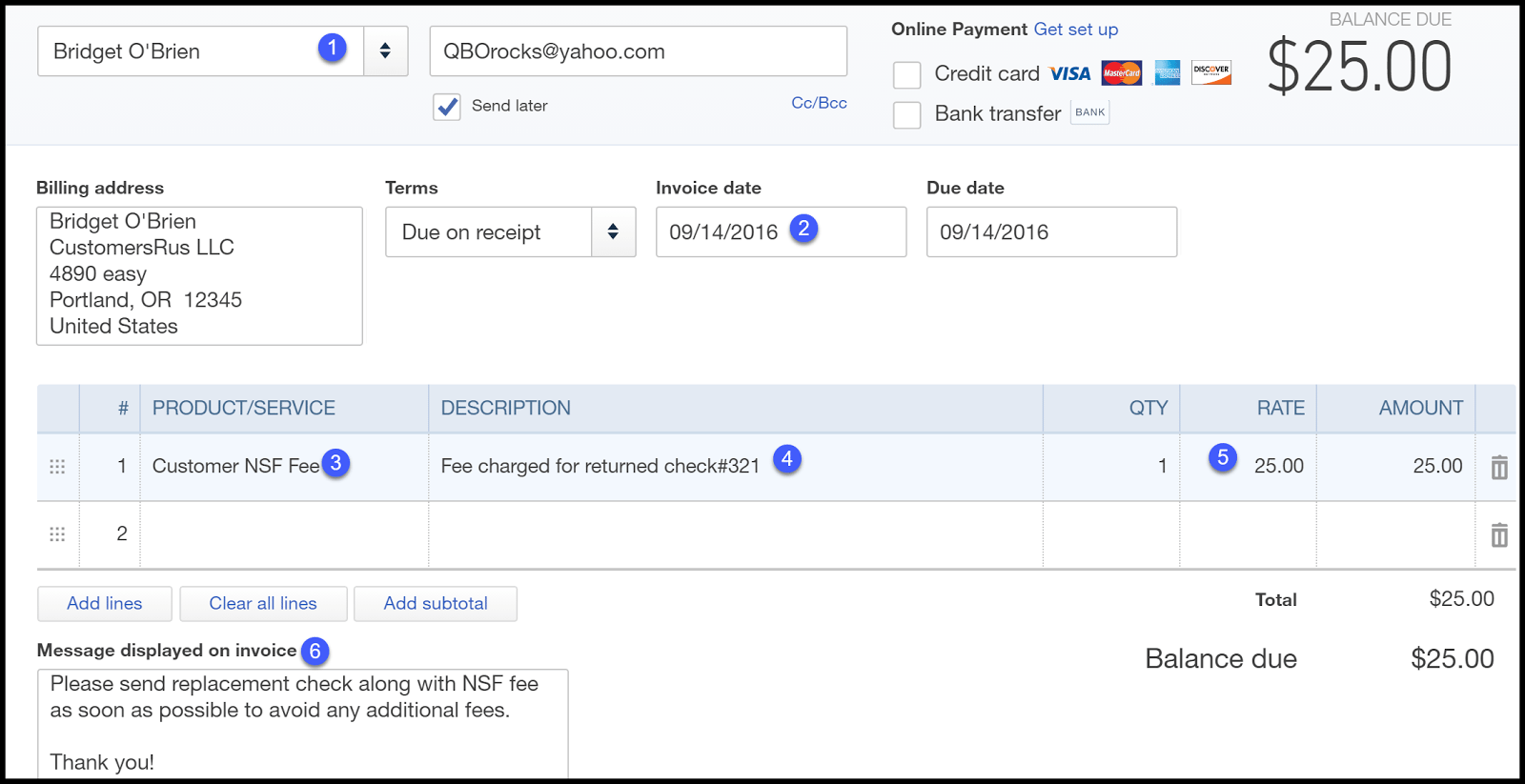

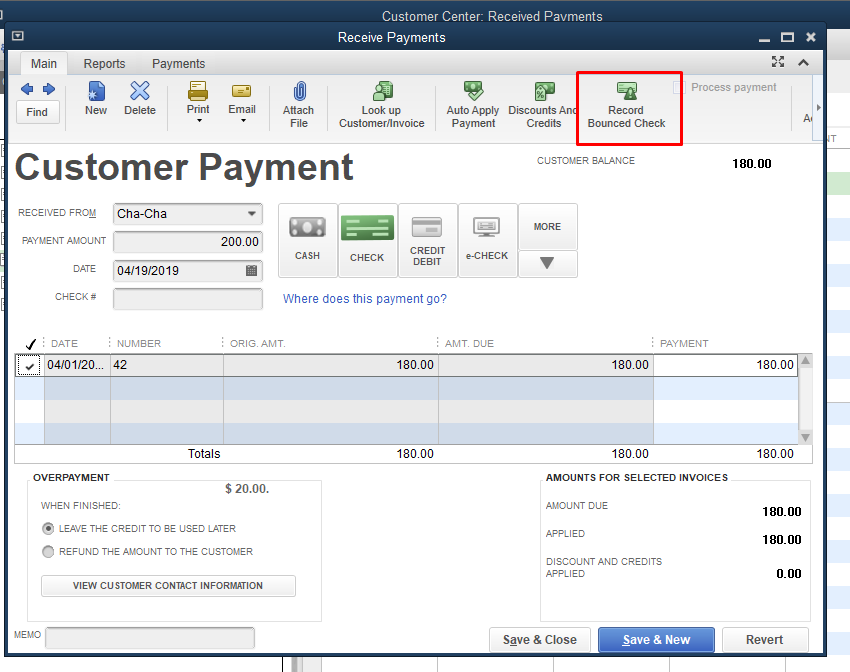

How to handle a returned check in quickbooks. Now we’ll record the payment that the bank took out. Learn how to record a bounced check in quickbooks online. Quickbooks includes a bounced check button on the record of each past transaction, so if a check does come back nsf, you can simply click.

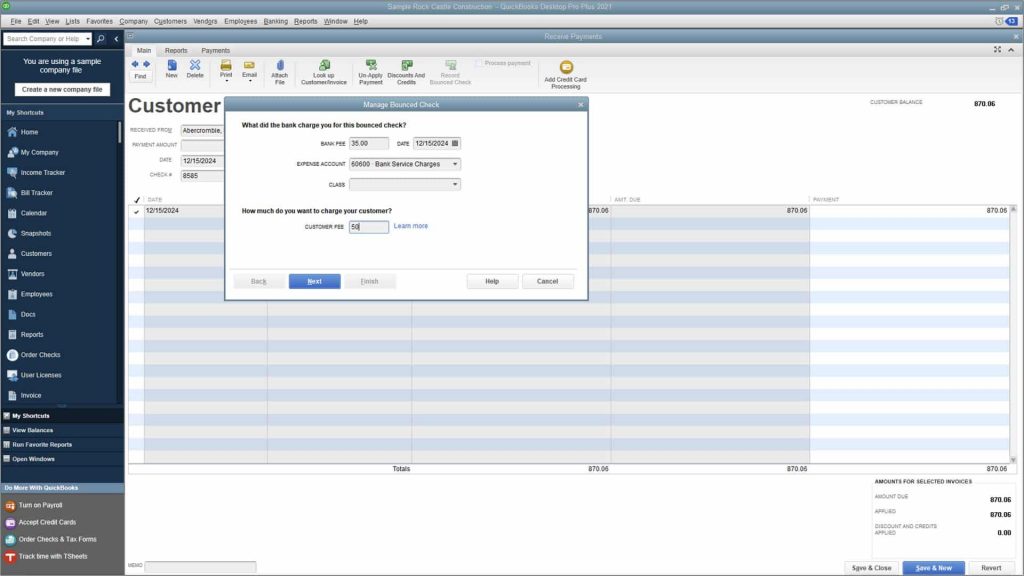

To record bounced checks in quickbooks desktop pro, select “customers| receive payments…” from the menu bar. You’ll need a clearing account. Get even more benefits with melio’s free payment solution—melio easily integrates with.

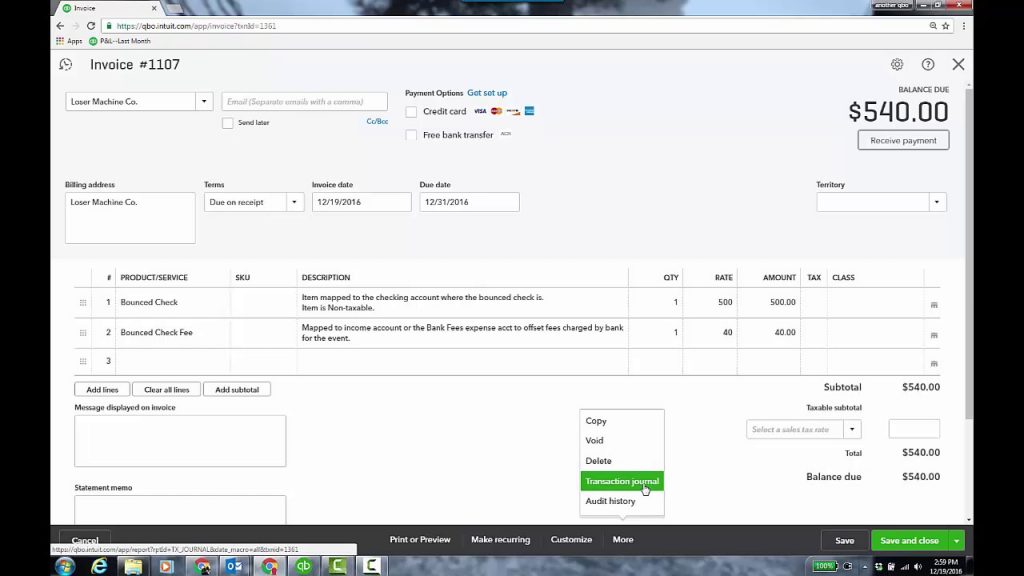

To handle a returned check in quickbooks desktop you need to record the bounced check as a deposit in your bank account. From the payment account dropdown, select the. Within quickbooks online, recording a returned check involves accessing the appropriate transaction form or module to accurately document the details of the returned payment.

Locate the returned check the first step is to locate the returned check and gather the necessary details. Let’s call it, “cash and checks clearing, ” and set it up as a bank account. You can do this by going to the banking menu,.

Enter the bounced check as an expense the first step is to enter the bounced check as an expense: Had a customer payment returned by the bank? Record the decrease in bank balance with the scenario above, let’s decrease the chase checking balance since the $240 check from aaron davis.

Then find or navigate to the specific customer. Make sure to have the check number, the. When a customer’s check is returned for insufficient funds, perform the following steps in quickbooks® first, check to see if these items have already been set.